Gold Shines Bright as Global Investors Turn to Safe-Haven Assets Amid Economic Uncertainty

Delhi – Optimism surges as gold prices rise above $4,000 per ounce, reflecting renewed investor confidence and steady demand across global markets.

Gold prices continued their upward trend on Friday, showcasing the metal’s enduring strength as a global safe-haven asset. Investors turned to gold amid growing optimism over potential U.S. Federal Reserve rate cuts and uncertainty surrounding the prolonged government shutdown.

Spot gold climbed 0.8% to $4,010.72 per ounce, while U.S. gold futures for December delivery gained 0.7% to $4,019.50 per ounce. The rally highlights the market’s confidence in gold’s long-term value as central banks continue strategic buying and investors seek stability during economic turbulence.

Analysts suggest the metal’s momentum remains solid, supported by steady demand from global central banks and heightened expectations for monetary easing. Independent market expert Ross Norman stated that the underlying themes for gold’s strength—such as central bank accumulation and rate cut prospects—remain firmly in place.

Recent U.S. data revealed a slowdown in job creation, with significant declines in the retail and government sectors. The adoption of artificial intelligence and cost-cutting measures have also contributed to layoffs, prompting expectations that the Federal Reserve could introduce further rate cuts to stimulate economic growth.

Market analysts currently estimate a 67% chance of another Fed rate cut in December, up from 60% before the latest employment report. The Federal Reserve’s recent decision to reduce borrowing costs, coupled with Chair Jerome Powell’s comments indicating this might be the final cut for the year, further strengthened gold’s position in investor portfolios.

In times of uncertainty, gold often emerges as the preferred asset for investors seeking stability and long-term value. The ongoing U.S. government shutdown—now the longest in history—has intensified reliance on alternative indicators, pushing investors toward gold as a safe and profitable choice.

Commodity strategist Soni Kumari from ANZ emphasized that the focus has now shifted to broader macroeconomic data and the eventual resolution of the U.S. shutdown. These factors continue to bolster gold’s appeal, reinforcing its status as a secure asset during global disruptions.

The upward momentum in gold has also positively influenced the wider precious metals market. Silver saw an increase of 1.7%, reaching $48.80 per ounce. Platinum gained 0.9% to $1,554.66, while palladium rose 1.5% to $1,395.50. Although platinum and palladium are expected to record minor weekly losses, their resilience indicates growing investor diversification into multiple precious assets.

Experts believe that the current conditions present a favorable environment for sustained growth in gold prices. The combination of policy-driven optimism, central bank purchases, and safe-haven demand continues to drive confidence in the commodity.

Global investors are also closely monitoring inflation indicators and U.S. fiscal developments. As the Federal Reserve adopts a cautious approach to rate adjustments, gold’s role as a hedge against volatility and inflation becomes increasingly prominent.

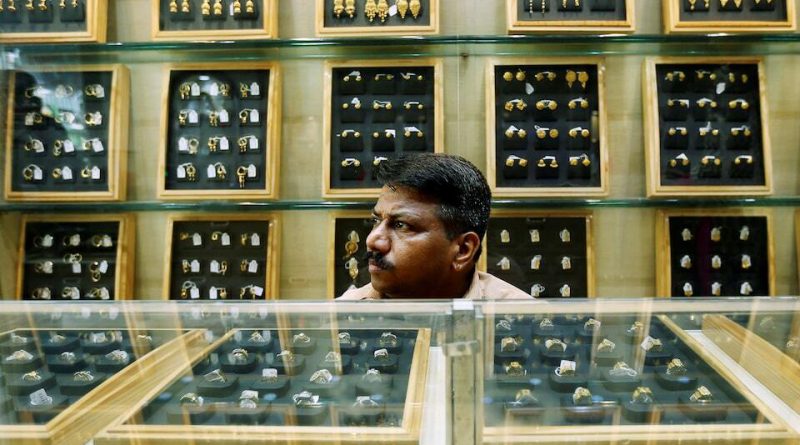

In India, one of the world’s largest gold-consuming nations, the market outlook remains strong. Festive demand, jewelry purchases, and investment inflows are expected to sustain upward momentum in the coming months.

With economic challenges and fiscal uncertainty continuing to shape global markets, gold’s rising trajectory underscores its lasting appeal and reliability. The metal’s consistent performance reaffirms its timeless status as a store of wealth, safeguarding investors amid fluctuating global dynamics.